🌊 Could OpenSea lose its seat as the leader NFT marketplace?

Let's dive into the controversies of OpenSea and upcoming competitors👀

Could the mighty OpenSea possibly lose its seat? Let’s see. 🌊

OpenSea has surpassed all expectations in the last couple of months, reaching almost $3.5 billion monthly volume in August (on Ethereum) and over $3 billion in September. The number of total OpenSea traders went from 20,000 in June to 425,000 to date, with NFTs going mainstream and celebrities joining the PFP craze. Trailing far behind OpenSea is SuperRare, which had a monthly trade volume of $26.5 million in August, followed by Foundation with $17.5 million in August. After the last couple of months, it became clear that OpenSea is the market leader with the largest monopoly on NFTs, with 98% of all Ethereum-based NFT trades taking place on the platform and reaching $1.14 billion in weekly trading volume during the last week of August. 💸

Despite Opensea’s success, recent events have made people question its position. Last month, OpenSea’s head of product Nate Chastain was accused of buying NFTs that he knew would be featured on the website’s front page, using insider information to purchase collections that would become in demand and, therefore, more valuable. The company issued a statement condemning the actions, saying that “this behavior does not represent [Opensea’s] values as a team.” OpenSea parted ways with Nate Chastain shortly after👋, hiring a third party to review its policies and advise on further action.

It seems that it wasn’t all too secret:

Earlier this month, there was another issue where a bug in the OpenSea code resulted in 42 NFT collectibles being accidentally burned, including the first ENS name ever registered, causing nearly $100,000 in the estimated loss.🔥🥵

These issues made some people question the longevity of the monopoly OpenSea holds. Monopolies historically cause the loss of progress and novelty, discourage innovation, and cause the loss of quality in products. While we haven’t seen any significant improvements on OpenSea, we have seen other marketplaces taking moves over the last few months to better their platforms.

Async Art released a Canvas tool that enables creators to upload work that changes every hour over 24 hours; Rarible introduced a new protocol and a set of tools to simplify the go-to-market process for NFT projects. 🎨 Nifty Gateway introduced a new tool, sending offers to users on specific traits. SuperRare also dropped its 2.0 version and $RARE token. Foundation added private sales, and artists can now use their smart contracts to mint and sell their work on Foundation directly, thanks to the support they got from Manifold.xyz. 🖼

But of course, we can look at things from OpenSea’s perspective since they had to upkeep an unprecedented number of people flooding their platform. That alone should have been a big task. And they have recently found a solution to public popular wallet addresses being bombarded by scam-like NFT projects. Now, NFTs transferred from a verified collection will be publicly visible on profiles by default, and those from unverified collections will be in the hidden tab of your profile account by default. You can change to showcase them anytime. We are also expecting to see the OpenSea mobile app soon.

The problems OpenSea had are making people question whether its monopoly is healthy and if it should be allowed.

People have expressed their discontent about OpenSea, and have been building new marketplaces that might be competitors to OpenSea. Dandelion tweeted that they are tired of “being adrift on open sea” and that they started building an ArtBlocks focused OpenSea competitor with lower royalties called Archipelago.art. When I reached out to them to ask what motivated them, they said, “My plan for Archipelago is to create actually something decentralized, not only a marketplace but a protocol.” They told me that they wanted to “focus on ArtBlocks in particular because it’s a very important marketplace, but it’s poorly served on OpenSea. You have to go through the scam projects. Features about exploring a particular collection on ArtBlocks, bid for all Squiggles features, you need such features but they don’t really exist on OpenSea.”

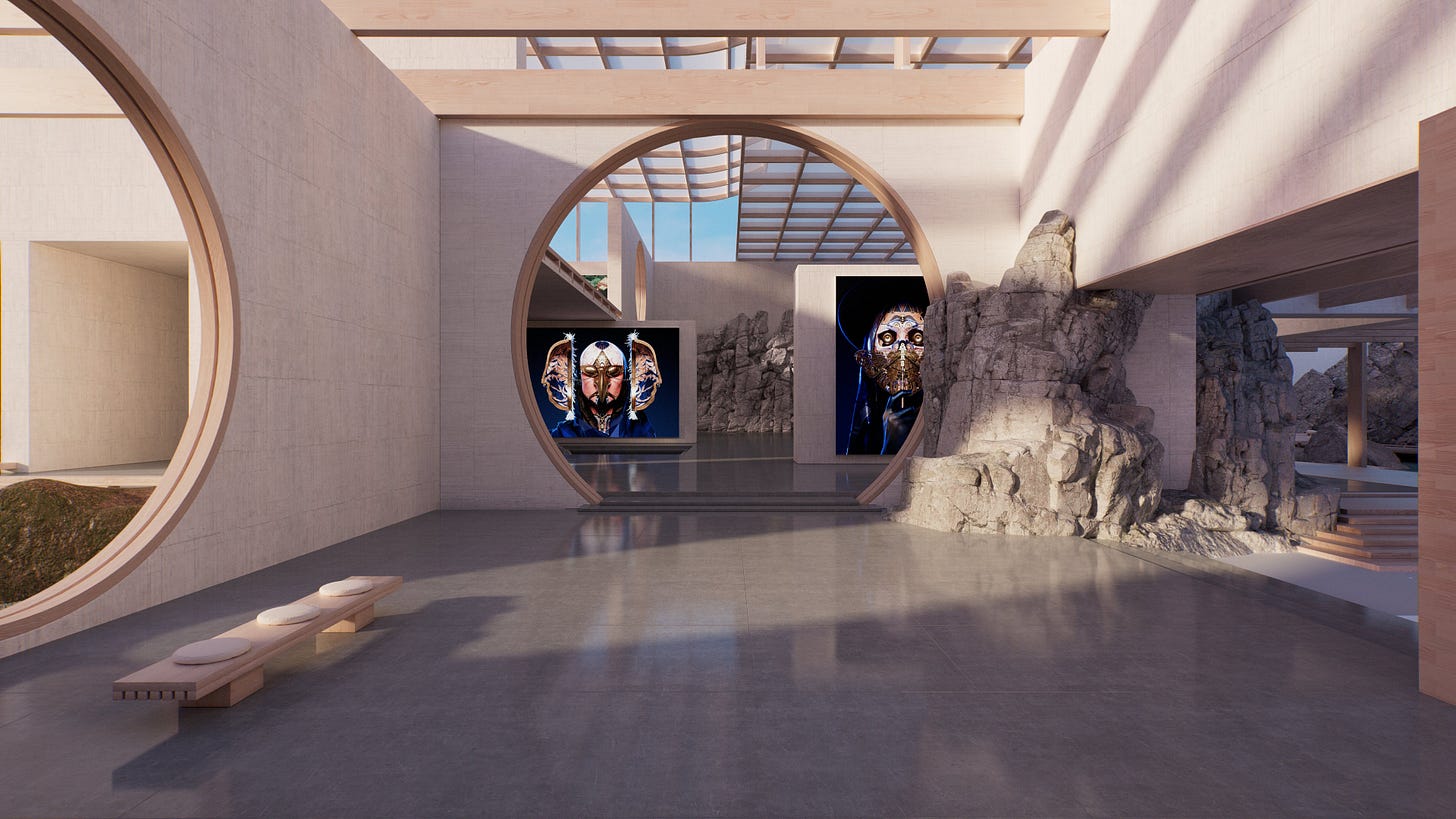

SushiSwap is building its curated marketplace called Shōyu, with ten artists per week for the first ten weeks. SushiSwap has previously announced that a “Japanese sensibility and aesthetic” will guide the marketplace. Shōyu will let creators mint social tokens, have fractional ownership, and use the Dutch auction model. They changed the marketplace fee structure considerably, where 2.5% of fees will be distributed to $xSushi holders for every marketplace transaction. I have to say, seeing the sneak peeks coming from Shōyu, I am very excited to see the actual platform.

NFTX protocol also launched NFTX Marketplace, the “world’s most liquid decentralized NFT marketplace” where you can buy and sell multiple NFTs in one transaction and ease the buying process. Now PancakeSwap launched its marketplace on Binance Smart Chain on September 30th. And the name on everybody’s fingertips on Twitter: Coinbase. They will be launching their NFT platform; the craze around this can be portrayed such that when I signed up to be on the waitlist yesterday, my place on the line was 883,337.

With older marketplaces constantly working on making their platforms better and many new competitors coming to the scene, we might see OpenSea’s place being taken by another marketplace. While the gap in volumes seems huge at the moment, stranger things have happened before.